In the ever-evolving landscape of cryptocurrency, the concept of token unlocking events has become a focal point for investors and market analysts alike. One such event that has garnered significant attention is the upcoming unlock of Arbitrum (ARB) tokens. As we approach this pivotal moment, it is crucial to dissect the implications and potential outcomes of this event.

Understanding Token Unlocking

Token unlocking refers to the release of previously unavailable tokens into the market. These tokens are often part of the initial coin offering (ICO) or a fundraising mechanism where they are locked for a certain period to control the token’s supply and, by extension, its price stability.

Arbitrum’s Cliff Unlock

Arbitrum, a second-layer scaling solution for Ethereum, had announced a ‘Cliff Unlock’ scheduled for March 16, 2024. This event will see the release of 92.65 million ARB tokens, which equates to 3.49% of the total supply. The term ‘Cliff Unlock’ is used to describe the sudden release of tokens that have been held back from circulation until a predetermined date.

Market Speculation and Historical Precedents

The market’s response to such events can be unpredictable. Historical data suggests that token prices tend to experience volatility following an unlock. For instance, a previous unlock event for ARB saw an initial dip in prices, followed by a recovery period. This pattern is not uncommon in the crypto sphere, where market sentiment and investor behavior play significant roles.

Community Reactions

The crypto community is divided on the potential impact of the Arbitrum unlock event. Some investors view it as an opportunity to acquire more tokens at a potentially lower price, while others are wary of a sell-off that could depress prices further. This dichotomy reflects the speculative nature of cryptocurrency investments and the diverse strategies employed by market participants.

Strategic Considerations for Investors

For those looking to navigate the Arbitrum token unlock, several strategies may be considered. A common approach is to monitor the market closely leading up to the event, looking for signs of increased trading volume or price movements that could indicate the market’s direction. Additionally, understanding the broader market trends and the specific use case of Arbitrum’s technology can provide context for the event’s significance.

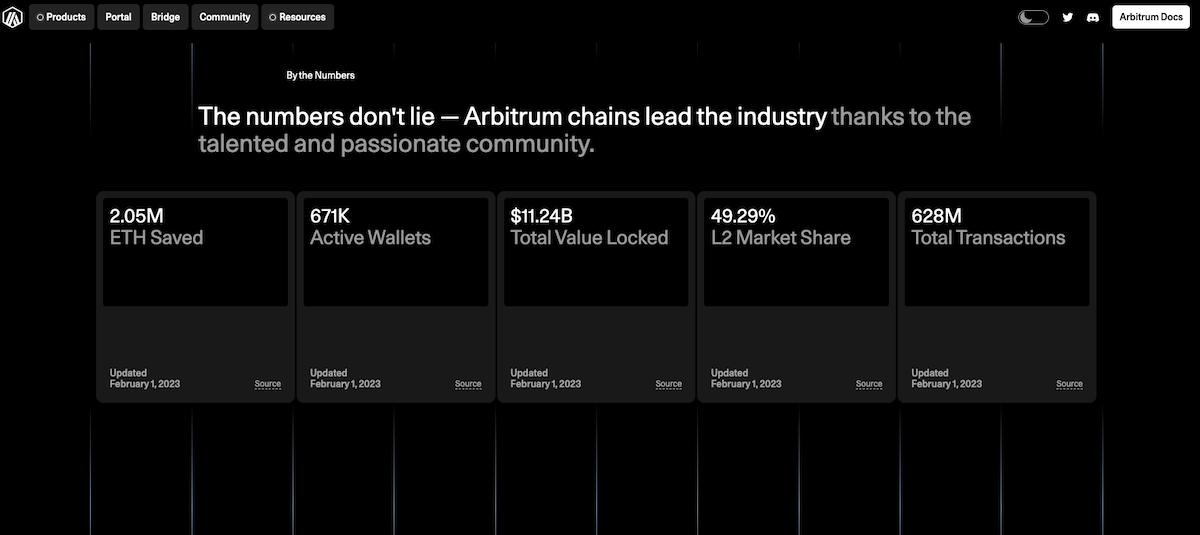

The Role of Arbitrum in the Crypto Ecosystem

Arbitrum’s role as a Layer 2 solution is to enhance the scalability and efficiency of Ethereum transactions. By unlocking these tokens, Arbitrum could potentially increase its liquidity and user base, contributing to the overall health of the Ethereum ecosystem. The success of such technologies is closely watched by the crypto community, as they represent the ongoing innovation within the space.

This article provides a comprehensive overview of the Arbitrum Token Unlocking Event, offering insights into the mechanisms of token unlocks and their potential effects on the cryptocurrency market. It is important to note that while the information presented is based on factual data, the future market outcomes remain speculative and should be approached with due diligence.